501c3 Organization Things To Know Before You Get This

Table of ContentsThe Best Guide To Non Profit Organization ExamplesNon Profit Organizations Near Me - QuestionsA Biased View of 501c3 OrganizationNon Profit Org Can Be Fun For EveryoneThe Single Strategy To Use For 501 CThe smart Trick of Google For Nonprofits That Nobody is DiscussingThe Best Strategy To Use For 501c3 OrganizationNot known Facts About Irs Nonprofit Search

Online giving has grown throughout the years, as well as it keeps growing. Unlike numerous other types of contributing (using a phone call, mail, or at a fundraiser event), donation pages are very shareable. This makes them optimal for boosting your reach, and for that reason the number of contributions. Furthermore, donation pages allow you to gather and track data that can notify your fundraising strategy (e.donation dimension, when the donation was made, who donated, just how much, just how they involved your internet site, and so on) Ultimately, donation web pages make it convenient as well as basic for your contributors to give! 8. 3 Produce an advertising and web content strategy It can be appealing to let your marketing create organically, but doing so offers even more issues than advantages.

You can likewise think about running an email project with routine newsletters that let your viewers recognize about the terrific job you're doing. Make sure to gather email addresses and also various other appropriate data in a proper way from the get go. 8. 5 Care for your individuals If you haven't dealt with hiring and onboarding yet, no fears; now is the moment - 501 c.

The Greatest Guide To Nonprofits Near Me

Choosing on a funding design is critical when beginning a not-for-profit. It depends on the nature of the not-for-profit.

For more information, check out our short article that speaks even more in-depth about the major not-for-profit funding sources. 9. 7 Crowdfunding Crowdfunding has actually turned into one of the vital ways to fundraise in 2021. Consequently, not-for-profit crowdfunding is ordering the eyeballs nowadays. It can be used for specific programs within the organization or a general contribution to the cause.

During this action, you may want to believe regarding landmarks that will suggest a chance to scale your nonprofit. As soon as you've operated for a little bit, it's essential to take some time to assume regarding concrete development goals.

501c3 Nonprofit for Beginners

Without them, it will certainly be difficult to review as well as track progress later on as you will certainly have absolutely nothing to gauge your outcomes versus and also you won't know what 'effective' is to your not-for-profit. Resources on Beginning a Nonprofit in numerous states in the United States: Beginning a Nonprofit Frequently Asked Questions 1. How a lot does it set you back to start a not-for-profit organization? You can start a not-for-profit organization with an investment of $750 at a bare minimum and also it can go as high as $2000.

For how long does it require to set up a not-for-profit? Depending upon the state that you remain in, having Articles of Consolidation approved by the state federal government may occupy to a couple of weeks. As soon as that's done, you'll need to obtain recognition of its 501(c)( 3) standing by the Irs.

With the 1023-EZ type, the handling time is normally 2-3 weeks. 4. Can you be an LLC as well as a nonprofit? LLC can exist as a nonprofit restricted obligation company, however, it needs to be completely possessed by a single tax-exempt not-for-profit organization. Thee LLC must also satisfy the needs as per the IRS required for Minimal Liability Business as Exempt Company Update.

Not known Facts About 501 C

What is the difference in between a foundation and also a nonprofit? Structures are typically moneyed by a household or a corporate entity, yet nonprofits are nonprofit partnership moneyed with their incomes and fundraising. Foundations generally take the money they started with, spend it, and after that distribute the cash made from those investments.

Whereas, the additional money a nonprofit makes are made use of as operating expenses to fund the company's mission. This isn't always true in the case of a structure. 6. Is it difficult to begin a nonprofit organization? A not-for-profit is a service, however starting it can be fairly intense, needing time, quality, and money.

Although there are several actions to start a nonprofit, the barriers to entrance are reasonably couple of. 7. Do nonprofits pay taxes? Nonprofits are exempt from government income taxes under area 501(C) of the internal revenue service. Nonetheless, there are certain scenarios where they might require to pay. If your not-for-profit earns any type of revenue from unrelated activities, it will certainly owe revenue tax obligations on that quantity.

The Best Strategy To Use For Non Profit Org

The role of a nonprofit company has constantly been to create social change as well as lead the means to a much better globe., we prioritize options that help our nonprofits boost their contributions.

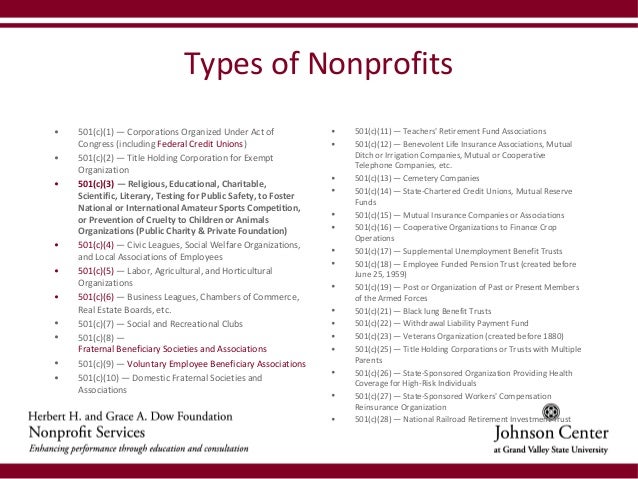

By much the most common type of nonprofits are Section 501(c)( 3) organizations; (Area 501(c)( 3) is the part of the tax code that accredits such nonprofits). These are nonprofits whose goal is philanthropic, religious, educational, or clinical.

This category is very important because private foundations undergo strict operating regulations and laws that don't put on public charities. For instance, deductibility of contributions to a personal foundation is a lot more limited than for a public charity, as well as personal structures go through excise tax obligations that are not imposed on public charities.

The Basic Principles Of Npo Registration

The bottom line is that exclusive structures obtain much worse tax treatment than public charities. The major difference between private foundations and public charities is where they obtain their economic assistance. An exclusive structure is typically regulated by a specific, household, or firm, and also acquires the majority of its income from a couple of benefactors as well as investments-- an example is the Expense and Melinda Gates Foundation.

This is why the tax obligation legislation is so difficult on them. Many foundations simply offer money to various other nonprofits. However, somecalled "running structures"operate their very own programs. As a functional matter, you need a minimum websites of $1 million to begin a private structure; or else, it's not worth the problem as well as cost. It's not unusual, after that, that a personal structure has actually been called a large body of cash bordered by people that desire some of it.

Non Profit Org for Dummies

If the IRS review identifies the nonprofit as a public charity, it keeps this standing for its first five years, despite the general public assistance it actually gets throughout this time. Beginning with the nonprofit's 6th tax obligation year, it must show that it satisfies the general public assistance examination, which is based upon the assistance it obtains throughout the current year and previous four years.

If a not-for-profit passes the examination, the internal revenue service will certainly proceed to monitor its public charity condition after the very first five years by requiring that a completed Schedule A be submitted each year. Locate out even more regarding your nonprofit's tax status with Nolo's book, Every Nonprofit's Tax Guide.